income tax rate malaysia

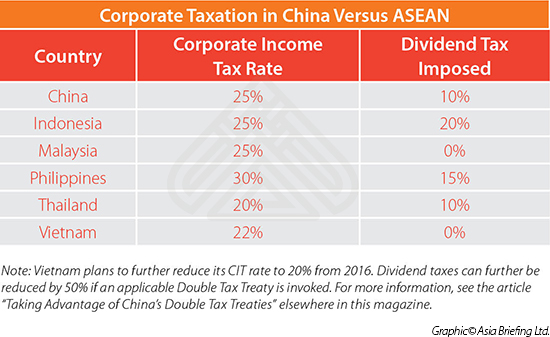

The standard corporate income tax rate in Malaysia is 24 for both resident and non-resident companies which gain income within Malaysia. RM9000 for individuals.

Asiapedia Corporate Taxation In China Versus Asean Dezan Shira Associates

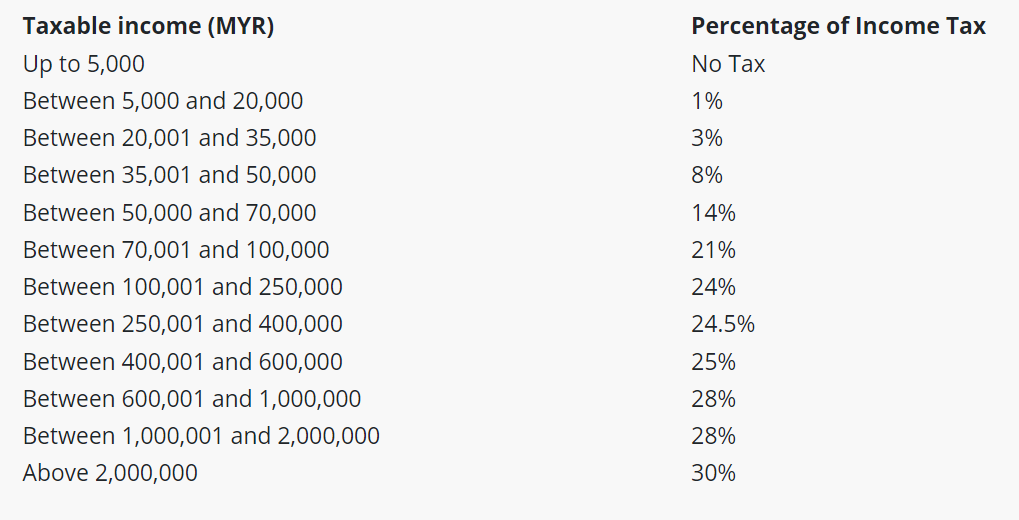

On the First 5000 Next 15000.

. An effective petroleum income tax rate of 25 applies on income from. Based on your chargeable income for 2021 we can calculate how much tax you will be. Tax is imposed annually on individuals who receive income in respect of.

On the First 20000. Taxable income band MYR. Tax Rates in Malaysia in 2022.

Malaysia has a progressive personal income tax system with a top rate of 30 and a tax rate that rises with an individuals income starting at. Taxable income band MYR. The Malaysian corporate standard income tax rate is 24 applicable to resident or non-resident companies that earn revenue inside Malaysia.

Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. Up to RM3000 for. Additionally the tax rate on those earning more.

Company having gross business income from one or more sources for the relevant year of assessment of not more than RM50 million. Malaysia Income Tax Rates in 2022. This means that low-income earners are imposed with a lower tax rate compared.

Tax RM A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. Malaysia has a territorial tax.

Based on this amount your tax rate is 8 and the total income tax that you must pay. Malaysia Income Tax Rates and Personal Allowances. Taxable income band MYR.

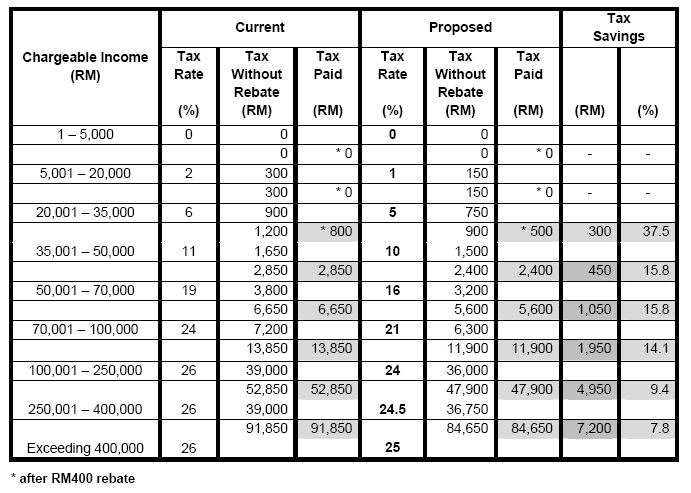

Calculations RM Rate TaxRM A. Malaysia adopts a progressive income tax rate system. Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax.

Malaysia Personal Income Tax Calculator for YA 2020. The Malaysia Income Tax Calculator uses income tax rates from the following tax years 2022 is simply the default year for this tax calculator please note. To put this into context if we take the median salary of just over 2000 MYR per month⁴ a resident would pay.

Additionally the tax relief for parents with children in kindergartens and childcare centres has been increased from RM1000 to RM2000. B Gains profit from employment. However there are exceptions for certain.

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. On first RM600000 chargeable income 17. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

However the blended tax rate is much lower for most residents. C Dividends interest or discounts. On the First 5000.

A Gains profit from a business.

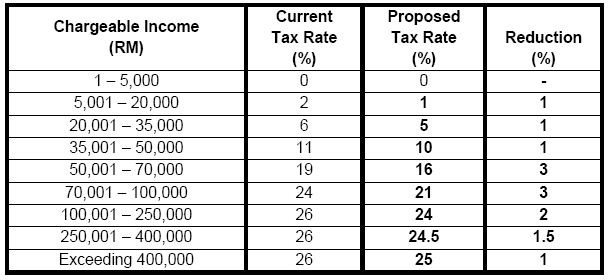

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News

What Is The Difference Between The Statutory And Effective Tax Rate

Malaysia Personal Income Tax Guide 2020 Ya 2019

Individual Income Tax In Malaysia For Expatriates

一起考cpa吧 Income Tax Singapore Vs Malaysia Just Realize Facebook

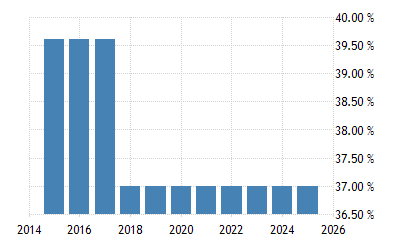

Chile Personal Income Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical

Malaysia Personal Income Tax Guide 2022 Ya 2021

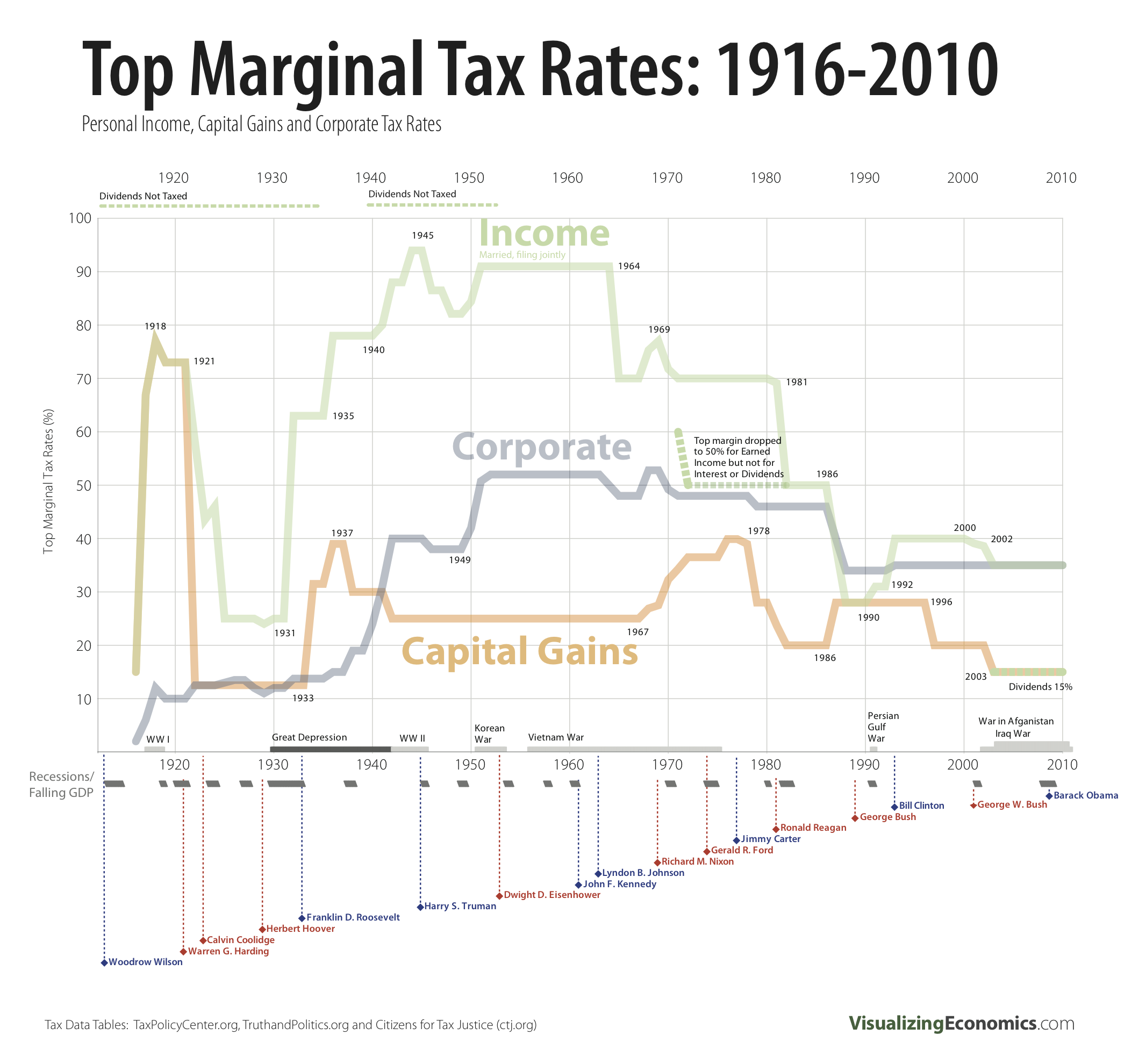

Fluctuations In Top Tax Rates 1910 To Today Sociological Images

Personal Income Tax And Top Personal Marginal Income Tax Rate 2009 Or Download Scientific Diagram

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News

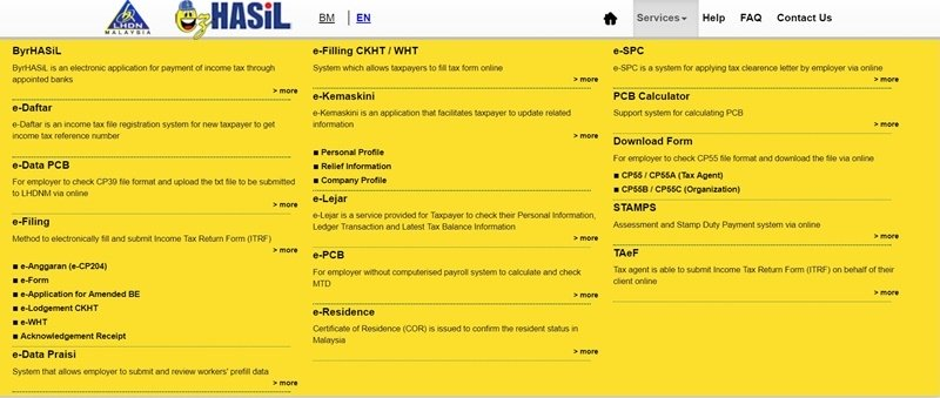

Abss Payroll V11 What S New Abss Accounting Malaysia

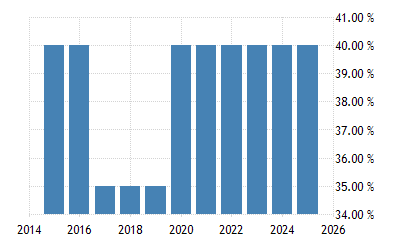

United States Personal Income Tax Rate 2022 Data 2023 Forecast

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

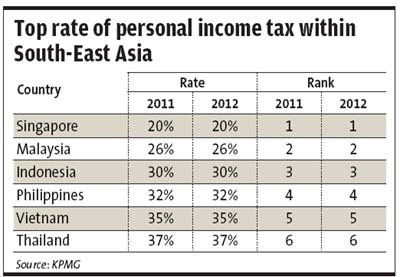

Malaysia Tax Rate Second Lowest In South East Asia The Star

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Bursa Dummy Tax On Rental Income

Budget 2022 These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets